Investors Approach With Cautionary Hunger

20 APR 2023

As a summary to the latest Q1 2023 quarterly crypto report by Pitchbook, it is noted that crypto companies raised $2.6B across 353 deals in global venture capital in the quarter. This would represent a 78% decrease in Q1 2022 and the lowest amount invested in the sector since Q4 of 2020. On the bright side, the report goes on to say that Web3 and DeFi are still leading funding activity in the venture capital space, even as the quarter represented a 12.2% decline in number of deals for the period in question.

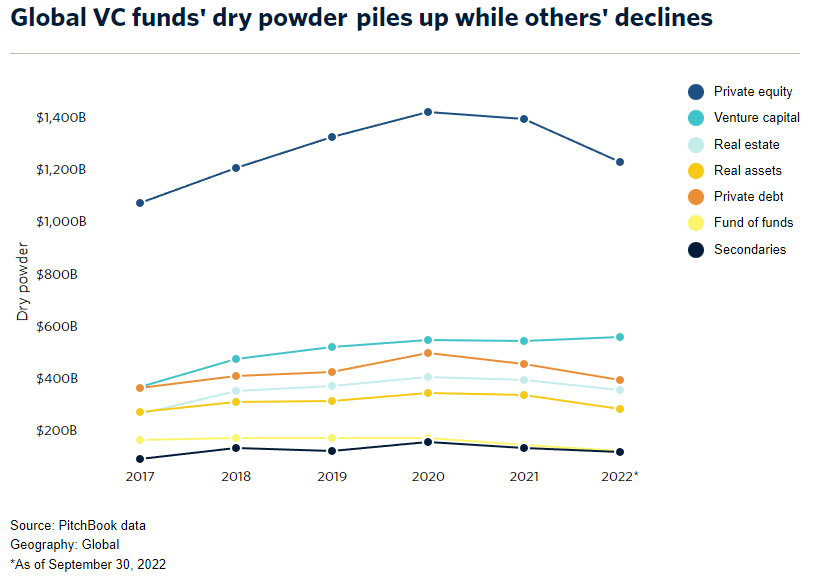

In even better news, venture capital firms’ dry powder continues to grow since 2017, even as cash piles fell across other private investment strategies, according to a separate report by Pitchbook. Global venture funds were sitting on a whopping $585.5B of capital raised but not deployed as of Q3 2022, noting that venture capital is the only private investment strategy in which dry powder is on track to rise from the levels seen in 2021.

If there is one thing we can infer from the above 2 paragraphs, we could logically conclude that investors in early-stage companies are still hungry to allocate their idle cash into projects, but taking a more cautious approach, obviously due to current market conditions. Having spoken to numerous venture capital firms and projects here at Omni3, we believe this is true.

From our experience, investors are telling us that gone were the days they would write a cheque to a project as early as ideation stage. Investors now mostly want to see some ability to generate revenues by the projects before diving deeper in their due diligence process. At the very least, its what we are told, the project has to have some form of traction, such as number of users or DAUs, beta launches, number of community members, LOIs or MOUs signed, with the best stamp of approval being already having committed investors in the same funding round.

The projects we have spoken to second what we say coming from investors. Even when their ideas are very captivating and investors could see the potential of getting a return on their investment, investors are still holding out for that concrete evidence, or a qualitative signal that the project could work. One reason why this could be the case is because VC funds are probably facing heightened scrutiny of their due diligence process from their limited partners (LP). We have heard of cases where limited partners are calling up VC firms demanding for explanations for investing in a project that went south.

It is quite a precarious time for general partners (GP) of VC funds. GPs are pressured by their LPs to deploy their funds with utmost caution while also feeling the squeeze by them to not leave their funds around idling (if not, why are they investing in your fund when they can better put their money to work elsewhere). Heading closer into the second half of 2023, we expect that though there could possibly be further fallout from the crypto markets, investors should be more adapt to current market conditions and become more willing to deploy capital, after getting a better sense of what works and what does not.

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy. Omni3 does not take into account of your personal investment objectives, specific investment goals, specific needs or financial situation and makes no representation and assumes no liability to the accuracy or completeness of the information provided here. The information and publications are not intended to be and do not constitute financial advice, investment advice, trading advice or any other advice or recommendation of any sort offered or endorsed by Omni3. Omni3 also does not warrant that such information and publications are accurate, up to date or applicable to the circumstances of any particular case. Any expression of opinion (which may be subject to change without notice) is personal to the author and the author makes no guarantee of any sort regarding accuracy or completeness of any information or analysis supplied. The authors and Omni3 are not responsible for any loss arising from any investment based on any perceived recommendation, forecast or any other information contained here. The contents of these publications should not be construed as an express or implied promise, guarantee or implication by Omni3 that readers will profit or that losses in connection therewith can or will be limited, from reliance on any information set out here.